Compliance with the regulatory and commercial law provisions for Impairment

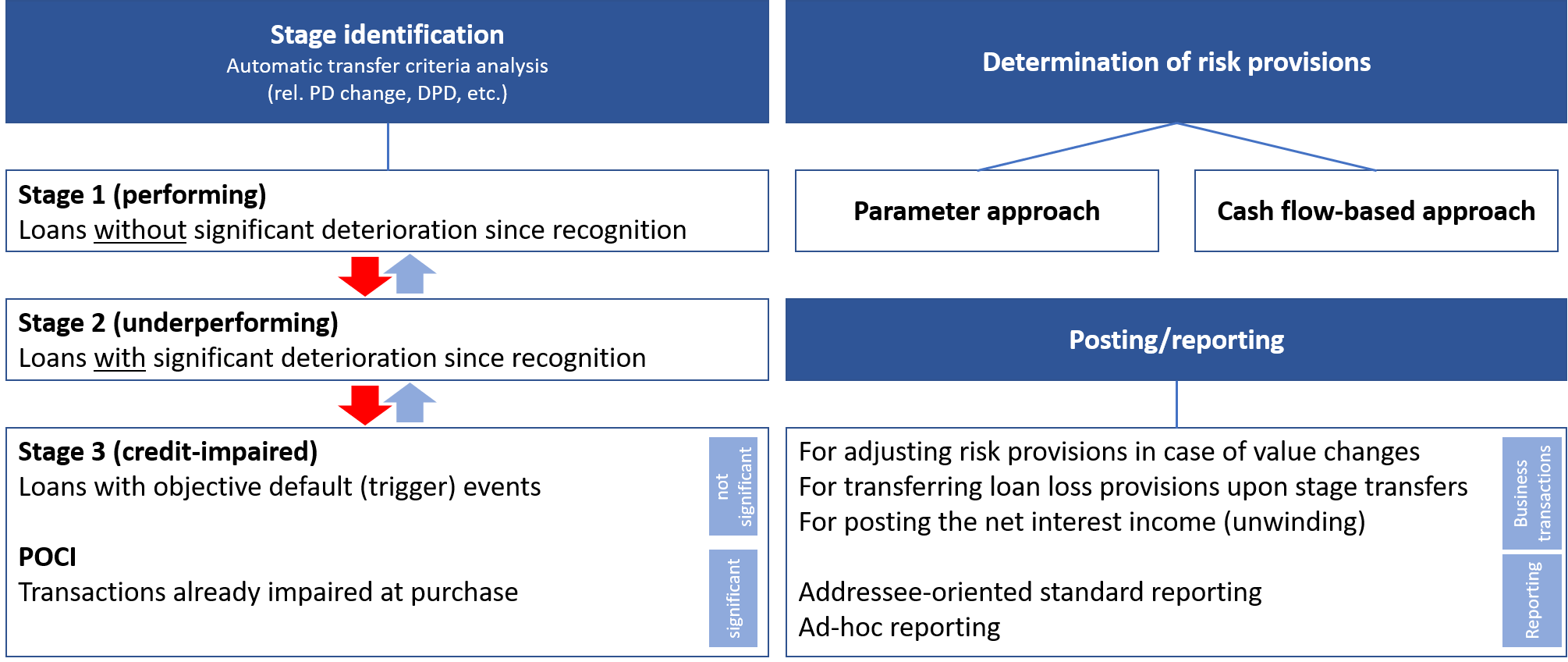

Unforeseeable impairments are not uncommon. It is essential to determine that they comply with IFRS for accounting purposes. An early implementation of the EL-based impairment model, test calculation for the management of the future P&L volatility and creating transparency for the transition pose particular challenges. In addition, reviewing and tracking periodic credit quality changes for (re)allocation to the three-step logic should be accelerated.

Complete representation of the entire IFRS process with zeb.control

- Implementation of the multi-level impairment process from data delivery to posting

- Calculation of specific and general loan loss provisions and unwinding effects in accordance with IFRS

- Institution-specific definition of step transfer criteria depending on borrower groups, volume, etc.

- Development of suitable EL/ELL calculation models and analysis of quantitative effects

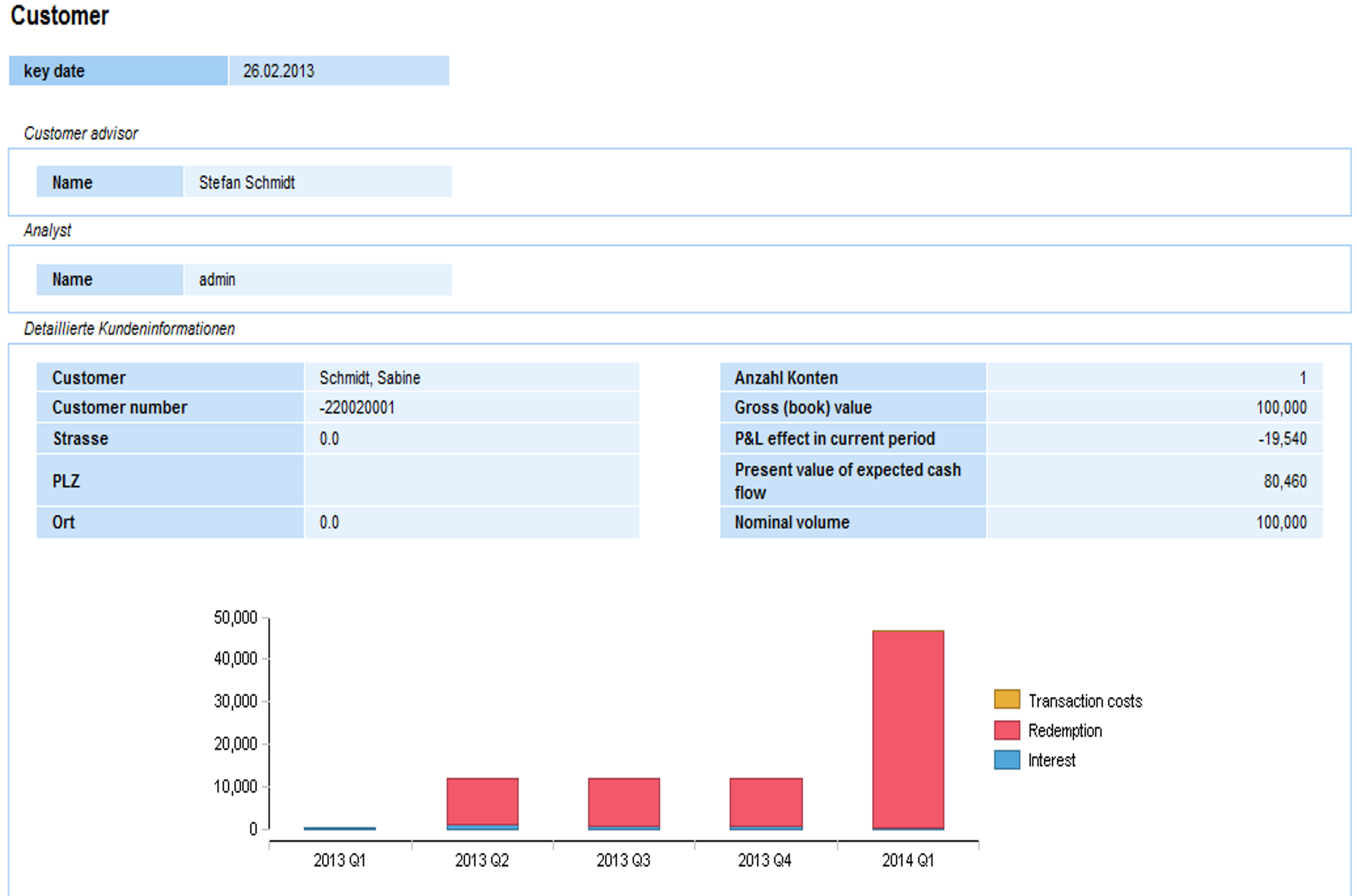

- Clearly arranged representation of the status of the different periods with a directly visible P&L impact

Learn more about the versatile possibilities of zeb.control!

The following product video shows the extensive functions of the software and demonstrates how you can access the multi-layered overviews and analyses of the accounting.

- Fully compliant with IFRS 9

- Parallel representation of IFRS 9 as well as HGB and UGB regulations

- Includes all, even complex valuation models

- Maximum flexibility in the delivery of parameters

Excerpt of our customers

Your contact persons

Apps that might also interest you