IFRS measurement

Support for the entire IFRS 9 and IFRS 13 measurement process for single transactions.

High requirements due to international accounting standards

The International Accounting Standards Board imposes a considerable burden on many credit institutions when it comes to the measurement of transactions. The IFRS 9 and IFRS 13 international accounting standards and other regulations must be fulfilled. The required calculation functionalities make considerable adaptation efforts within the institutions’ IT system landscape necessary. When analyzing existing loan agreements to determine their fair value, the measurement must take into account the creditworthiness of all parties to a financial instrument.

Individually mastering the challenges with zeb.control

- Modular and individually applicable calculation logic for valuation at full fair value as well as at amortized cost for lending and deposit business and proprietary trading

- Reusable standard valuation algorithms (function modules) from zeb or customized by the client

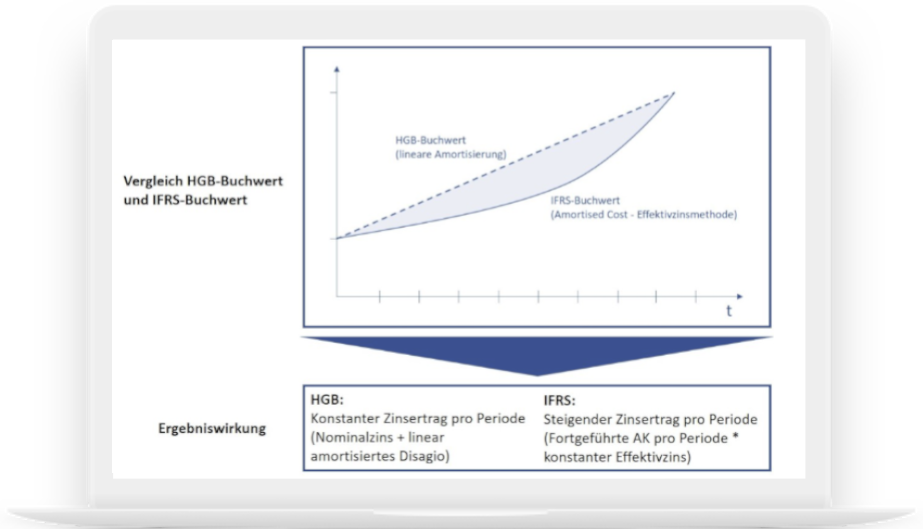

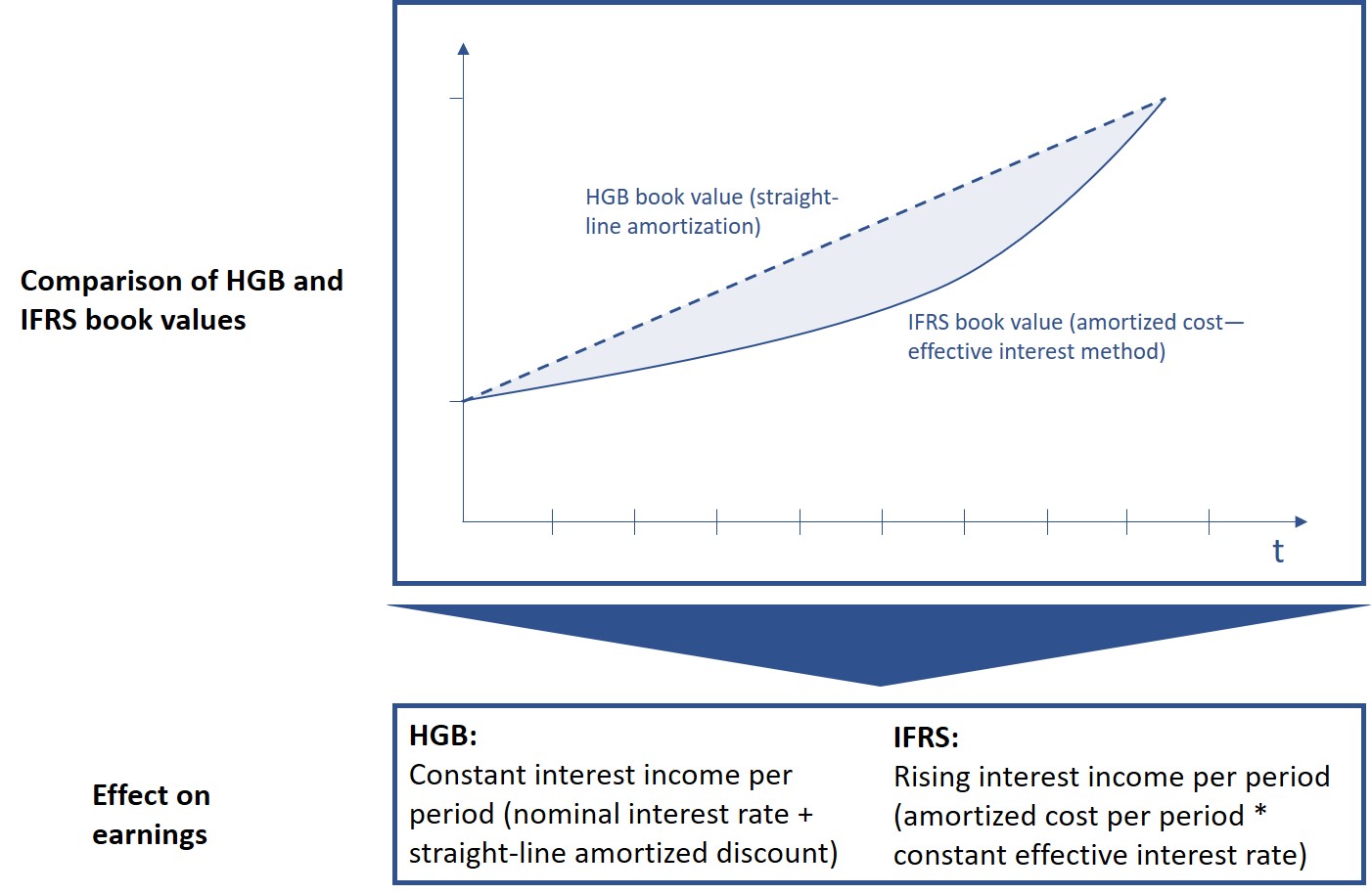

Amortized cost functionalities

- Support of all IFRS-relevant valuation methods for mapping all product types in commercial business and proprietary trading

- Determination of effective interest rate and book value calculation for client business

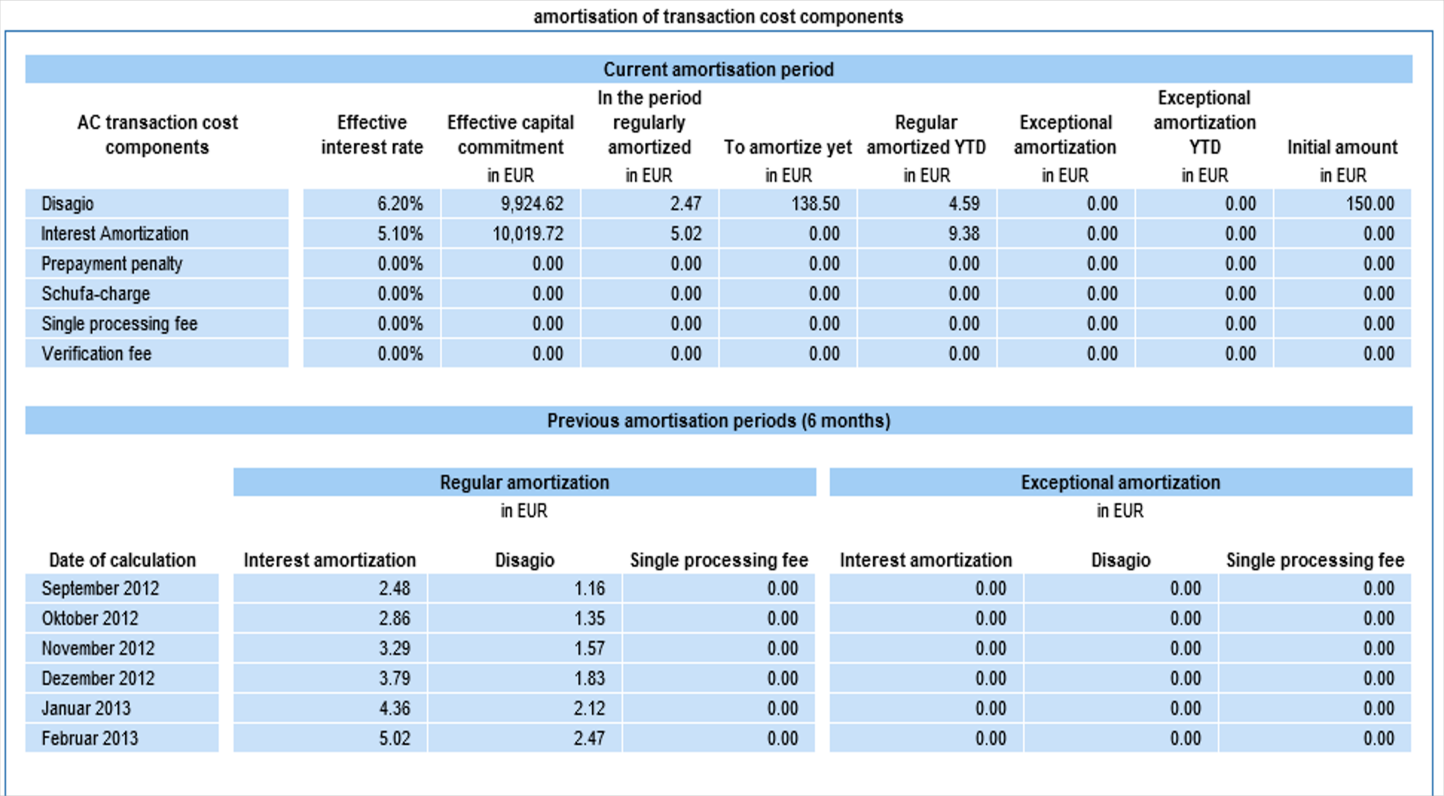

- Constant effective interest rate or linear amortization differentiated according to flexibly configurable transaction cost components such as (discounts), fees or commissions

- Special amortization in the event of default

Fair value measurement functionalities

- IFRS13 fair value measurement with Level 1 (use of quoted prices) and Level 3 (mark-to-model) measurement

- Consideration of spreads or spread curves (risk cost spread, liquidity spread, administrative cost spread, cost of equity spread)

- Differentiation between secured and unsecured fair value

- Valuation of optional components, consideration of interest rate options and termination rights via the Bachelier model

- Support of the entire IFRS measurement process—integrated in one solution

- Posting information for the balance sheet included

- Traceable results via details and intermediate results

- Reliable basis for controlling, impairment and other areas

- You benefit from zeb’s best practice expertise and IFRS 9 and IFRS 13 expert knowledge

Excerpt of our customers

Your contact persons

Apps that might also interest you

Articles you might be interested in