Challenges

Fast and simple calculation of regulatory liquidity reports

Many banks are faced with the complex and time-critical task of reporting requirements. Most IT structures reach their performance limits when implementing the required guidelines.

Solutions

zeb offers an effective risk management tool for integrated risk analysis and simulation for a financial institution’s risk controlling.

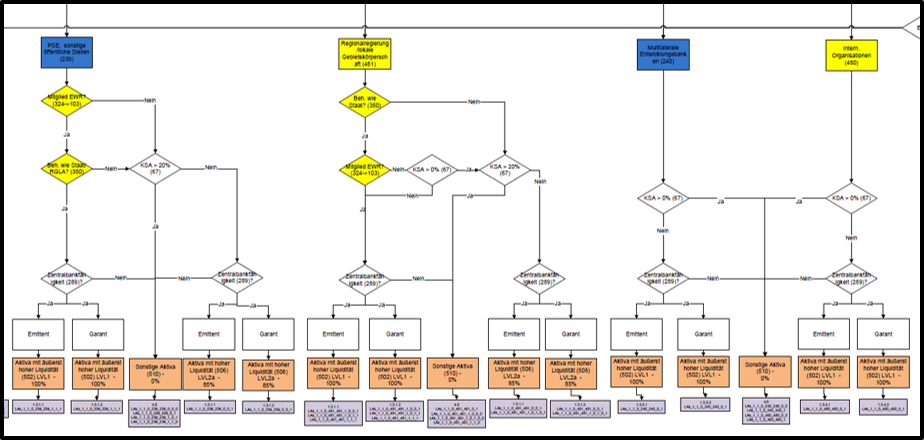

Comprehensive simulation of risk indicators including ICAAP / ILAAP indicators from a normative and economic perspective

- Flexible selection of indicators to be taken into account when determining the risk-bearing capacity

- Normative approach: scenario-dependent minimum capital ratios and intuitive definition of basic and adverse scenarios

- Economic approach: configuration of the RCP calculation, flexible options for risk calculation and definition of stress scenarios for scenario and sensitivity analyses

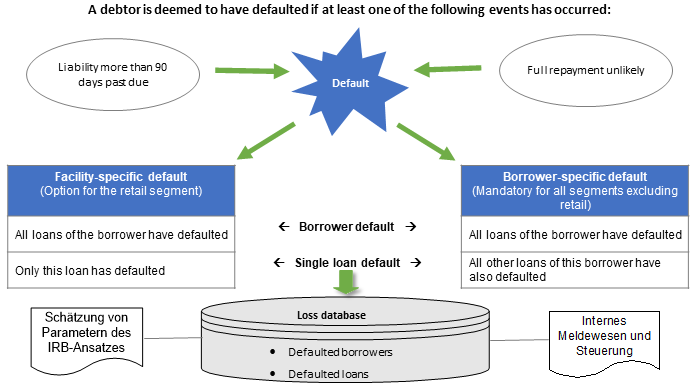

- Comprehensive diagnosis reports on credit risk indicators

Benefits

- zeb’s expert knowledge of legal and regulatory requirements

- Compliance with current BaFin requirements through a dual RBC concept

- Transparency about the risk situation of your company

- Sustainability through continuous development with regard to professionalism and usability

References

Excerpt of our customers

Contact

Your contact persons

Related Apps

Apps that might also interest you