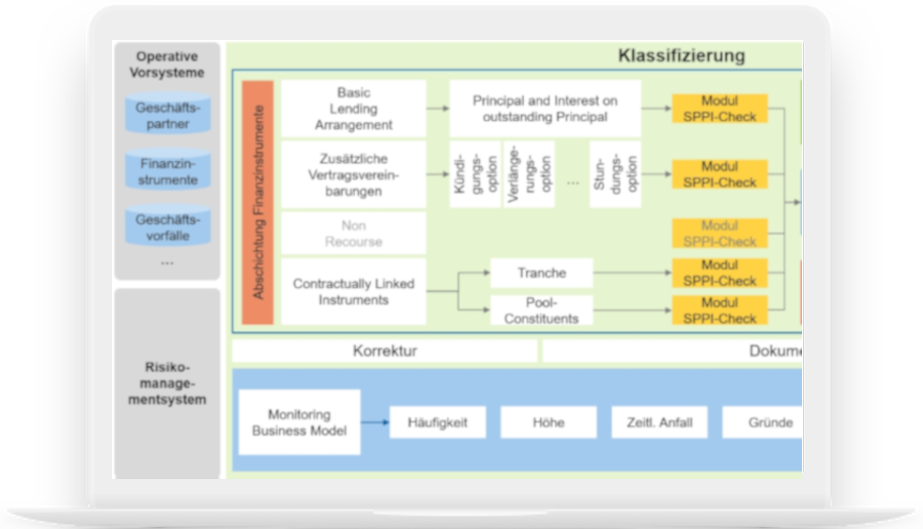

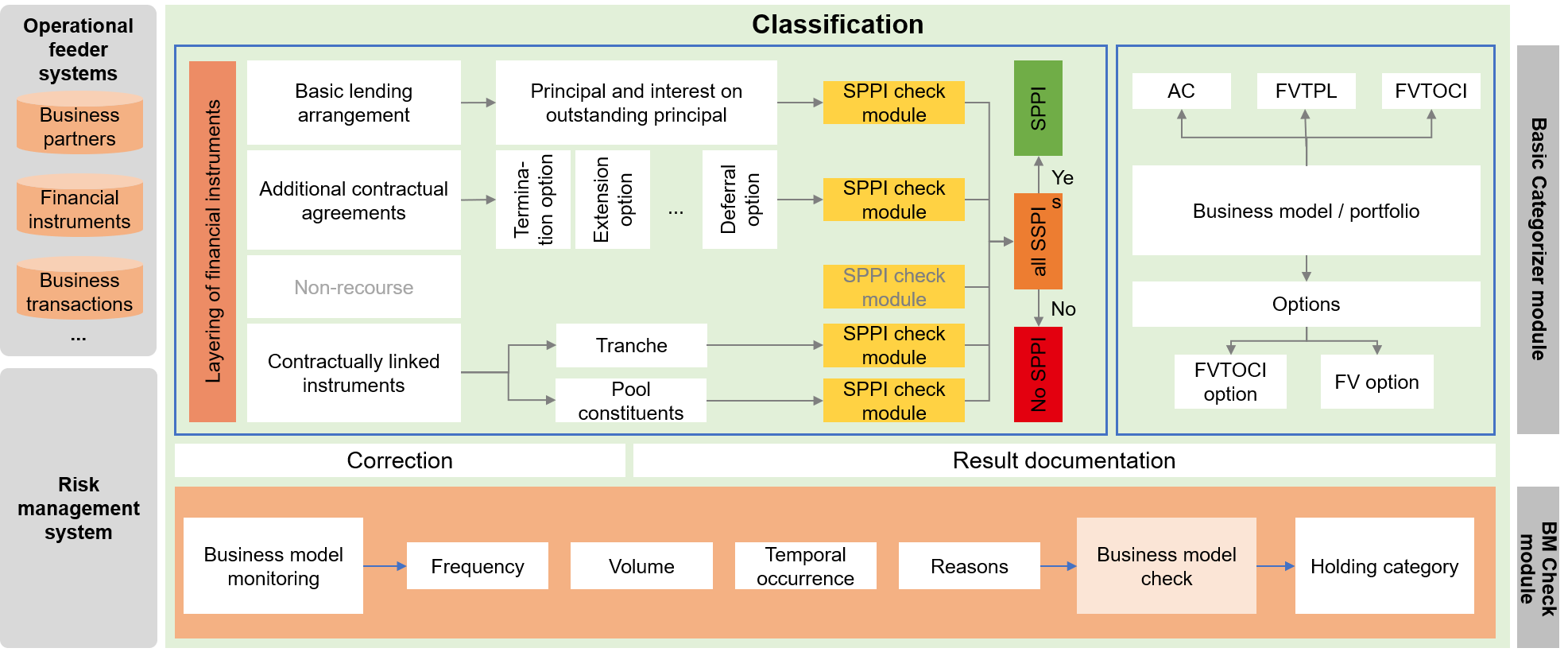

Classification

Unique and client-specific classification of financial assets and liabilities into categories in accordance with IFRS 9.

Classification according to the strict IFRS 9 regulations

The classification of a financial asset depends on various criteria. Proper categorization in accordance with IFRS 9 requires mastering a number of challenges. Business models and portfolios, for example, must be examined for the necessity of applying the fair value approach, in order to make use of the scope for AC valuation. Classification usually takes place at portfolio level, as this often represents the bank’s management level. It is possible to aggregate several portfolios, provided this is consistent with management.

Client-specific classification with zeb.control

- Unique and client-specific classification of financial assets and liabilities into categories in accordance with IFRS 9

- Simulation-based determination of the scope of the product portfolio to be recognized at fair value

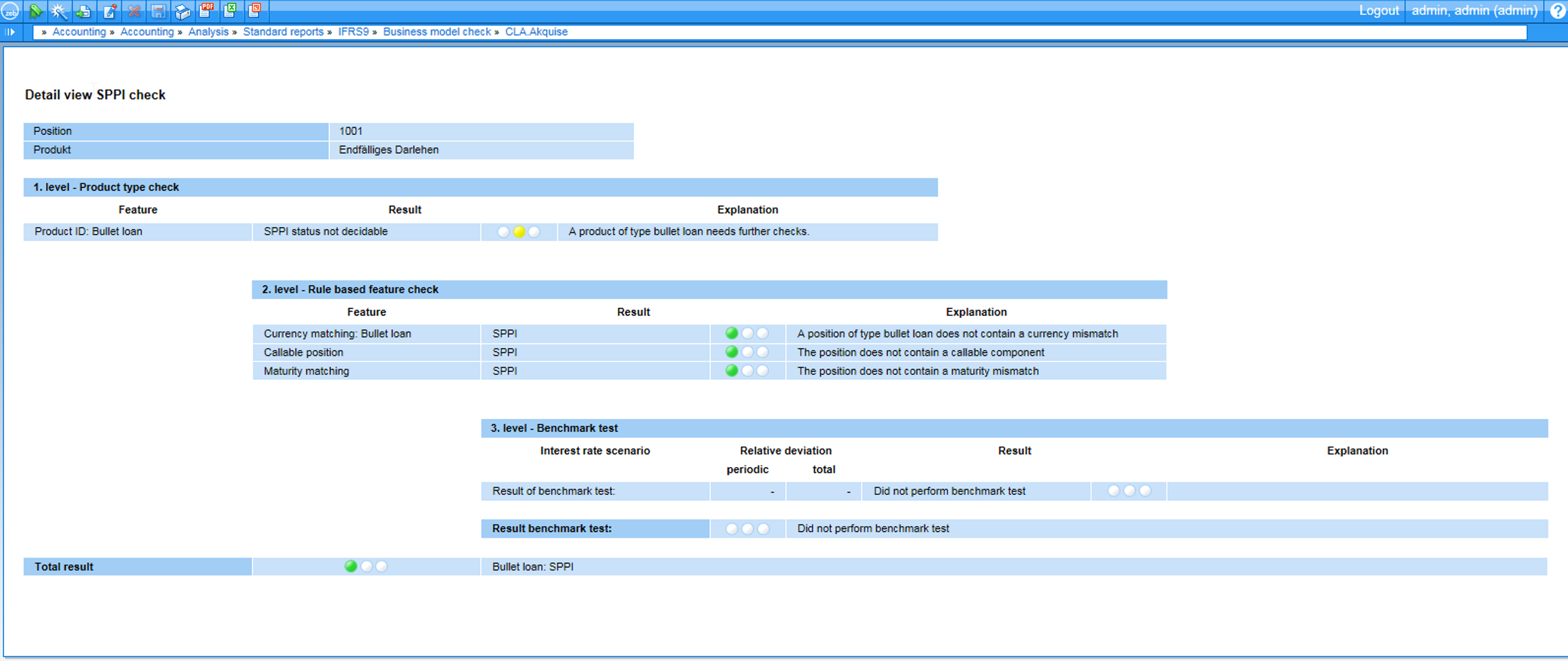

- Assessment of the contractual CF characteristics

Experience the versatile possibilities of zeb.control live!

The following product video shows the extensive functions of the software and demonstrates how you can access the multi-layered overviews and analyses of the accounting.

- User-friendly definition of categorization rules via an intuitive graphical user interface

- Time-saving and security through automatic detection of conflicts and inconsistencies within the categorization rules

- Audit-proof solution including logging

Your contact persons

Apps that might also interest you

Articles you might be interested in