zeb.control »

Interest Rate Risk

Compliance with additional requirements/guidelines by means of a comprehensive software solution.

Challenges

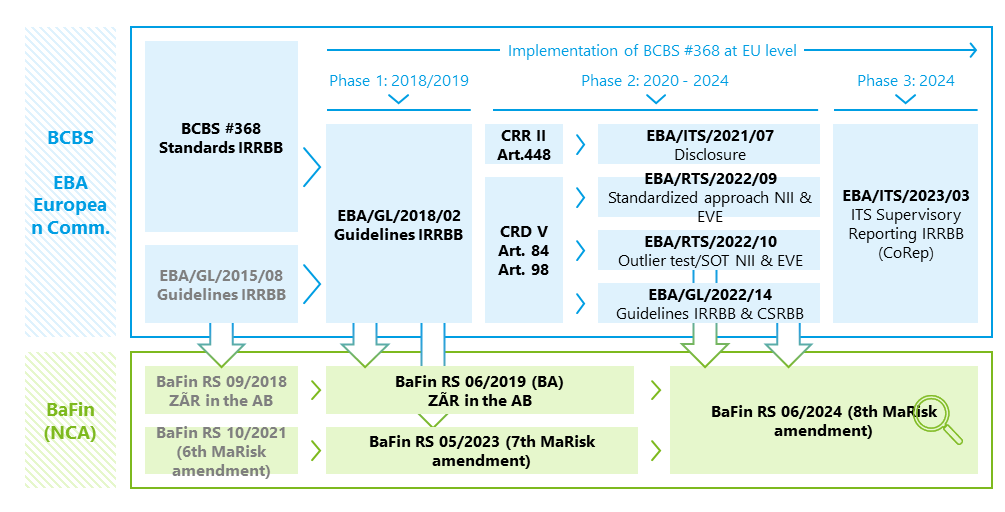

EBA guidelines call for comprehensive management of interest rate risks in the banking book

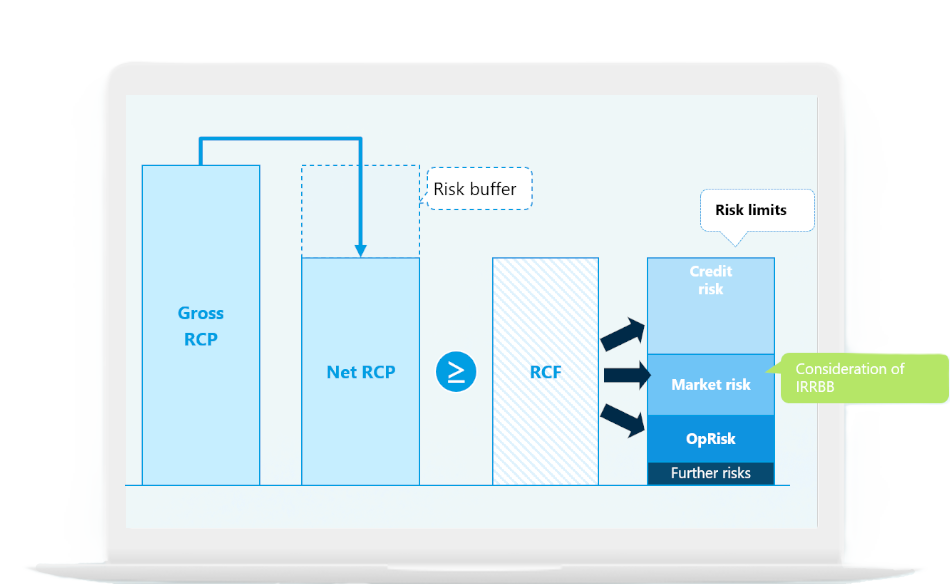

The European Banking Authority’s guidelines on the management of interest rate risk in the banking book aim to ensure that banks hold sufficient capital to absorb potential losses resulting from interest rate changes. These guidelines require many banks to make extensive modifications to their interest rate risk measurement and management and to adjust their capital reserves. A comprehensive software solution should be implemented to meet the additional requirements.

Solutions

Efficient and easy implementation of the IRRBB guidelines with zeb.control

- Configuration and flexible, system-based simulation of:

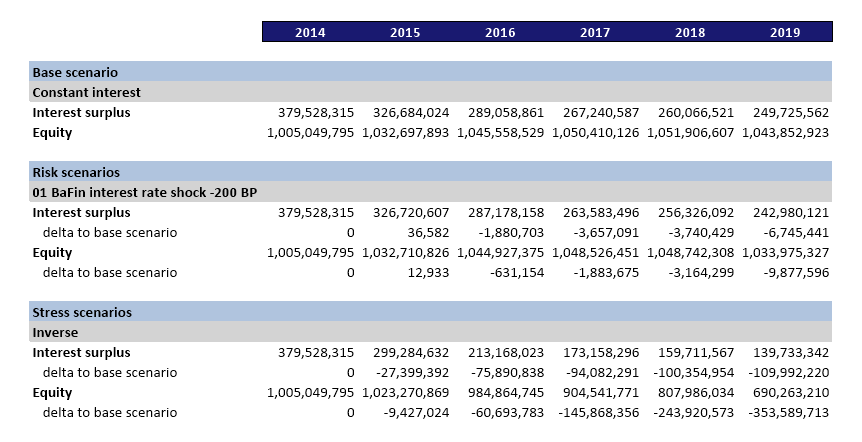

- multi-year periodic scenario analyses (e.g. risk and stress scenarios, also for the NZU or the EBA stress test / STE) taking into account periodic valuation effects

- economic (present value) scenario analyses (including risk and stress scenarios according to EBA/GL/2018/02 or BaFin RS 06/2019) as well as VaR simulations (including HistSim, MC)

- Adquate consideration of IRRBB sub-risks (basis and option risk) and credit spread risks in the banking book (CSRBB)

- IRRBB reporting according to BCBS #368 or EBA/GL/2018/02 and BaFin RS 06/2019 (present value outlier test)

Benefits

- Compliance with regulatory requirements

- Transparency regarding the structure of interest rate risks

- Optimization of interest income while ensuring compliance

- zeb expertise included

References

Excerpt of our customers

Contact

Your contact persons

Related Apps

Apps that might also interest you