zeb.control »

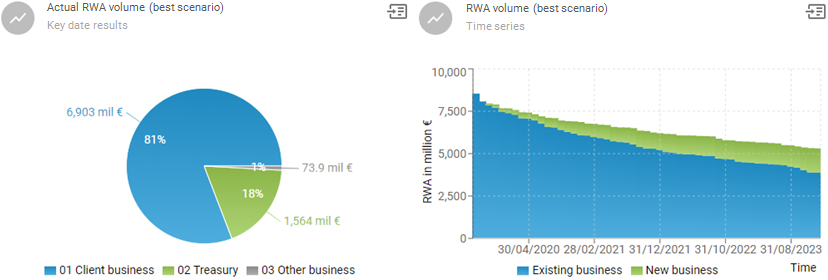

Risk-weighted assets (RWA)

Detailed evaluation options based on a comprehensive and user-friendly software solution.

Challenges

Strong pressure to adapt due to regulatory changes

The Basel Committee on Banking Supervision has determined that the use of a risk-weight approach is the preferred method that banks should use for capital calculations. To meet the regulatory requirements in a sustainable manner, the calculation results need to be analyzed in detail based on a comprehensive and user-friendly software solution.

Solutions

zeb.control helps you ensure both compliance and efficiency

- RWA calculation in line with regulatory requirements

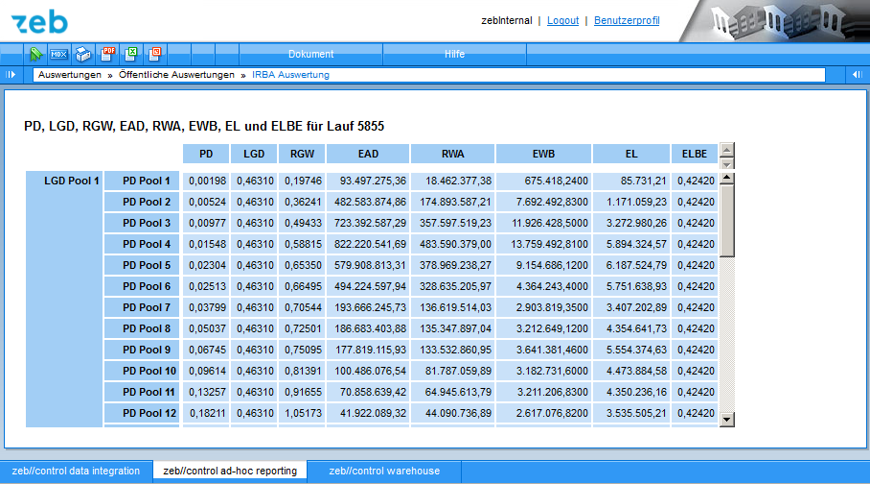

- Capital requirements calculation for the standardized approach and the IRB basic / IRB retail approach

- Includes, among others, elements for risk weight determination, optimized distribution of collaterals and capital requirements calculation per business transaction

- Calculation of amounts for operational risk

- Extensive authorization system including a state-of-the-art front end for working quickly and efficiently and for secure operation by the administrators

Benefits

- Transparency: access the various calculations at any time, including comprehensive drill-down and filter options

- Swift implementation: benefit from our wide-ranging implementation expertise

- Expert knowledge: draw on comprehensive expertise regarding legal and regulatory requirements, gained at international institutions of varying size and complexity

- User-friendliness: enjoy state-of-the-art technology with intuitive user interfaces

References

Excerpt of our customers

Contact

Your contact persons

Related Apps

Apps that might also interest you