zeb.control »

Market risk management

Early recognition and active countermeasures in the event of possible negative market developments.

Challenges

An active management of market risks is very important

Continuously increasing regulatory stipulations require banks to apply an active and professional risk management. Moreover, active market risk management enables you to optimally align your portfolio and to recognize possible negative developments in the markets at an early stage and to actively counteract them.

Solutions

Quickly and easily analyze possible market risks through simulations

This module provides you with many helpful solutions for efficient market risk management:

- All common risk indicators and sensitivity measures are available

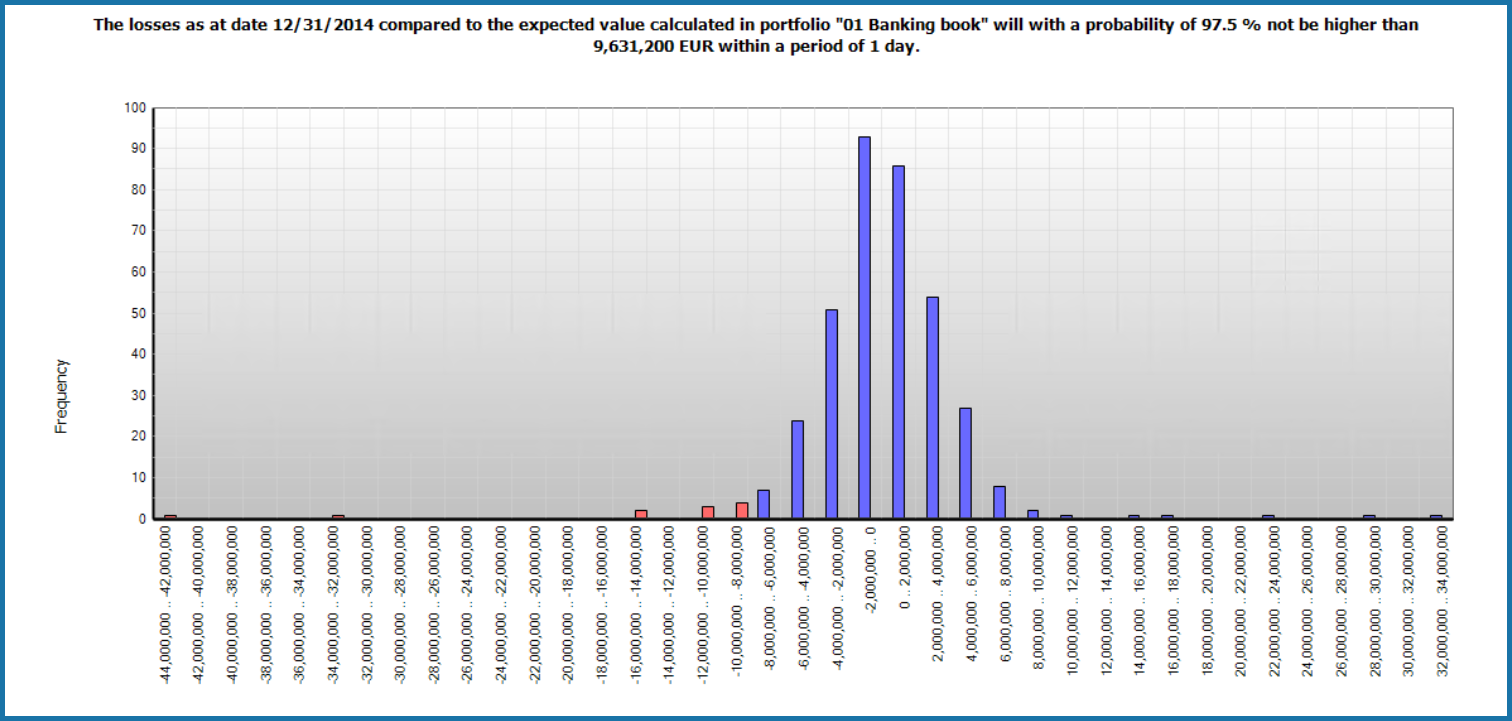

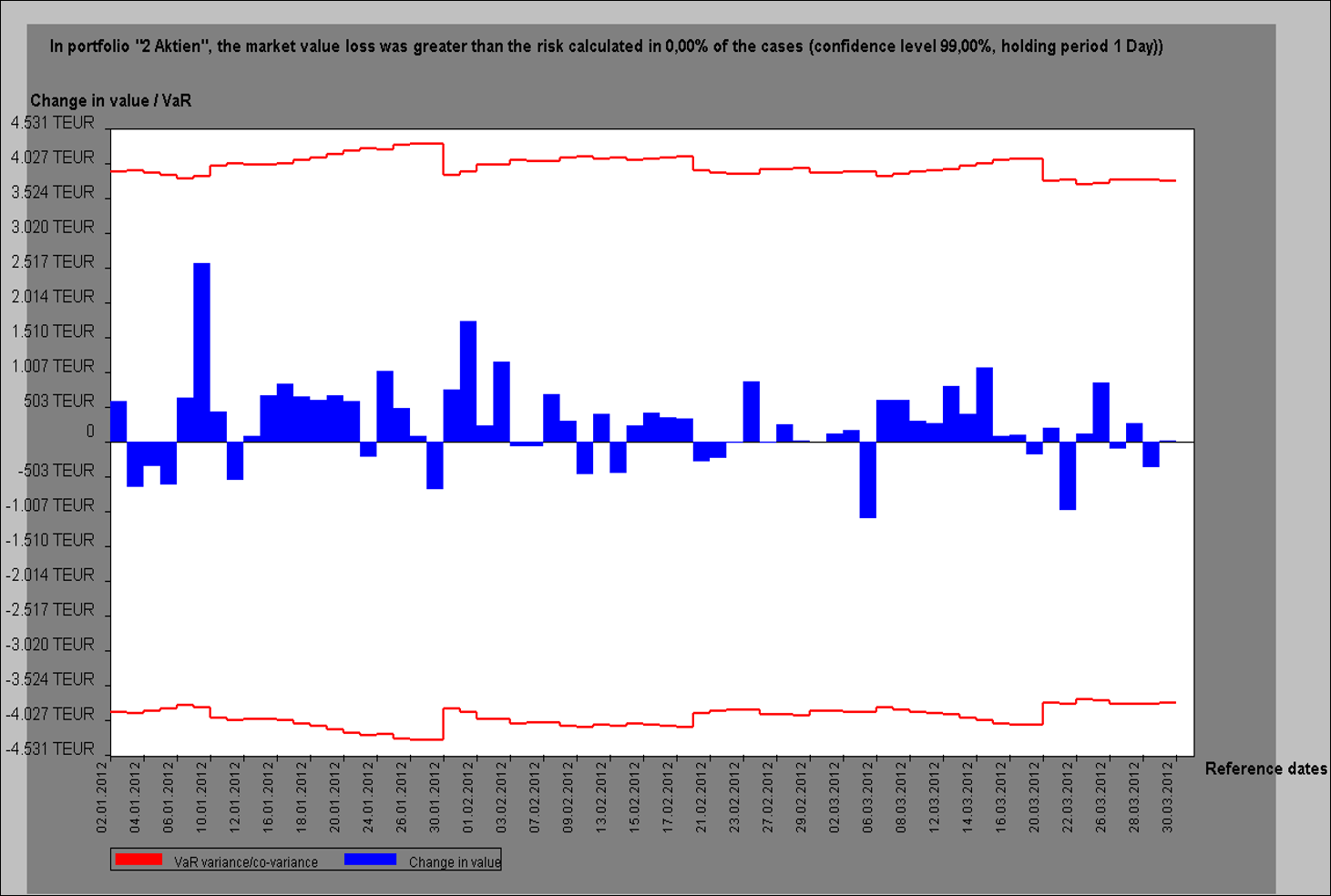

- Risk determination using individually configurable value-at-risk methods (variance-covariance or historical simulation)

- Backtesting to validate the risk models used

- Simulations of market price and interest rate risks with explicit (stress) scenarios

- Representation and monitoring of highly differentiated and comprehensive limit concepts

- Detailed monitoring of FX positions

Benefits

- Comprehensive compliance with the supervisory MaRisk requirements

- Overview of all risks at all times

- Secure control processes through workflow support provided by the system

References

Excerpt of our customers

Contact

Your contact person

Related Apps

Apps that might also interest you