Credit risk

Flexible credit portfolio module aligned with ICAAP, MaRisk, and RTF guidelines.

Constantly growing demands on a financial institution’s risk management

The regulatory requirements for the ICAAP, from MaRisk and RBC guidelines place high demands on credit risk management. Especially the applied management perspective with its considerable implications for the measurement process is critical. For many banks, procuring and integrating an adequate software solution is an enormous effort. In-house solutions, however, increasingly fail to comply with internal and external regulatory requirements.

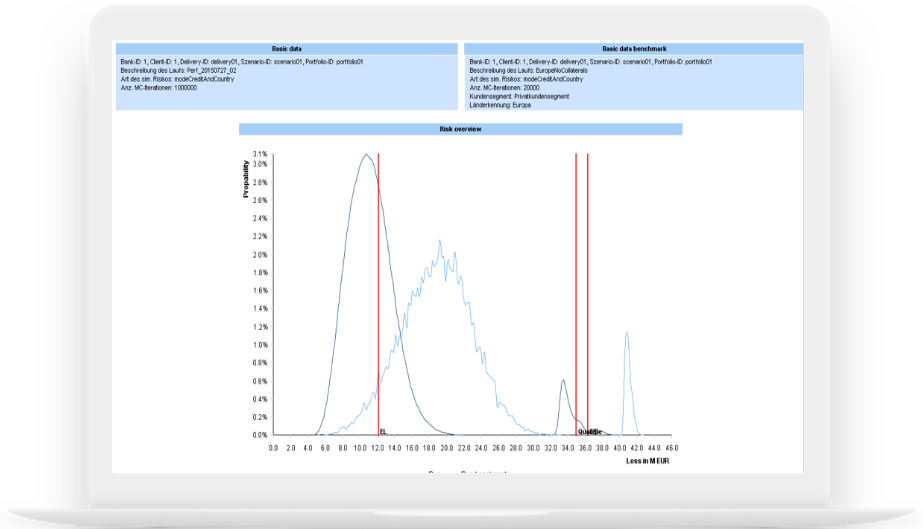

Fast and simple determination and analysis of credit risks

Credit is an innovative and flexible module for credit portfolio management that can be flexibly adapted to a client’s requirements. We offer the following key functionalities:

- Simulation model based on an asset-value approach with methodical flexibility and comprehensive parameterization capability

- Direct display of the most important key indicators from the risk scenarios as an entry point to scenario analysis

- Extensive standard reporting and multi-dimensional result cubes enable an effective cause analysis

- Simple creation of standard and stress scenarios via integrated scenario management

- Traceability of the calculation results ensures compliance with audit requirements

Experience the versatile possibilities of zeb.control live!

The following product video gives you an overview of the extensive functions of the software and shows you exemplarily how to access the multi-layered overviews and simulations.

- Regulatory requirements for ICAAP and from MaRisk and RBC guidelines are fulfilled

- IDW PS 880-certified

- High work efficiency through automation of risk scenario simulations

- Short simulation times through the use of scalable resources

- Out-of-the-box usability, even as a cloud-based application — zero implementation effort

Excerpt of our customers

Your contact persons

This app might also interest you