Challenges

High income expectations require professional and comprehensive simulations

Continuously increasing regulatory requirements and a high market volatility together with high income expectations require banks to apply an active and professional analysis of possible future developments.

Solutions

Agile treasury management through comprehensive scenario management

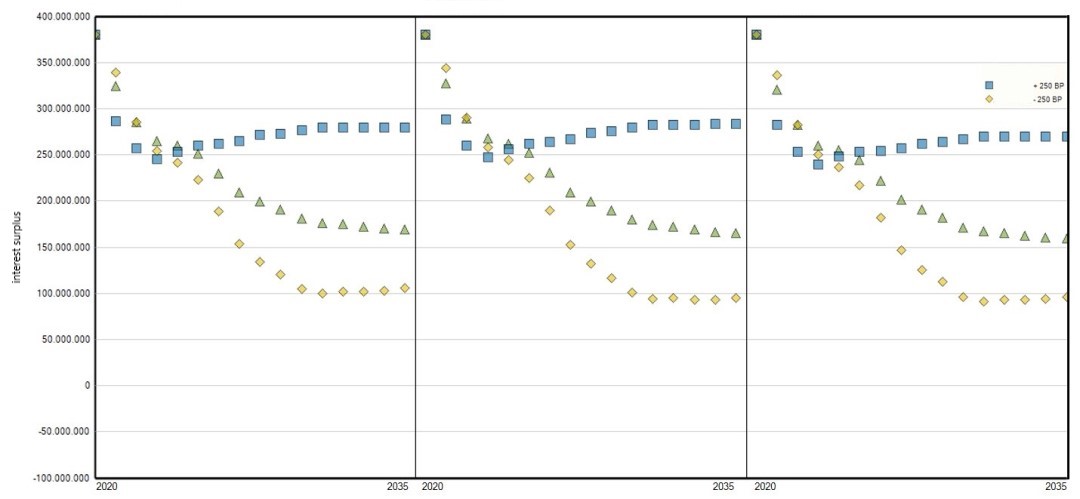

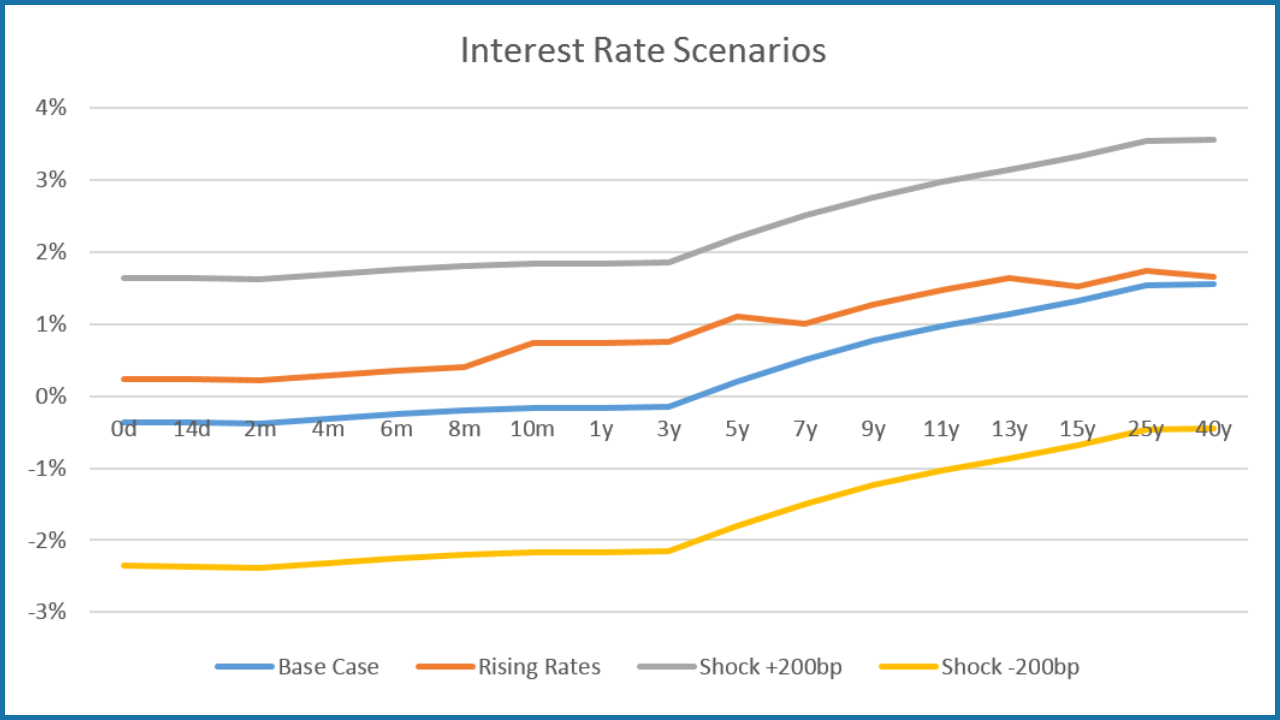

The Treasury module uses a wide range of scenarios to enable a comprehensive simulation of possible market developments and hedging measures. The following functionalities, among others, are available:

- Periodic and net present value simulation of balance sheet and P&L statement

- Simulation of standard interest rate shocks and individual market scenarios

- Comprehensive scenario management and clear administration of the different scenario types

- Manual and automatic generation of measures

Video

Experience the versatile possibilities of zeb.control live!

The following product video shows the extensive functions of the software and demonstrates how you can access the multi-layered overviews and analyses.

Benefits

- Transparency regarding possible future interest income developments

- Need for action is identified at an early stage

- All optimization possibilities are exploited

References

Excerpt of our customers

Contact

Your contact persons

Related Apps

Apps that might also interest you

Articles

Articles you might be interested in