Flexible management system for profit planning and management necessary

Many banks are faced with the challenges of reconciling management impulses from present value and periodic planning and implementing regulatory requirements. This requires a targeted management of the balance sheet structure and the associated overall bank-wide interest and liquidity risks.

Proven tool for an efficient asset and refinancing management

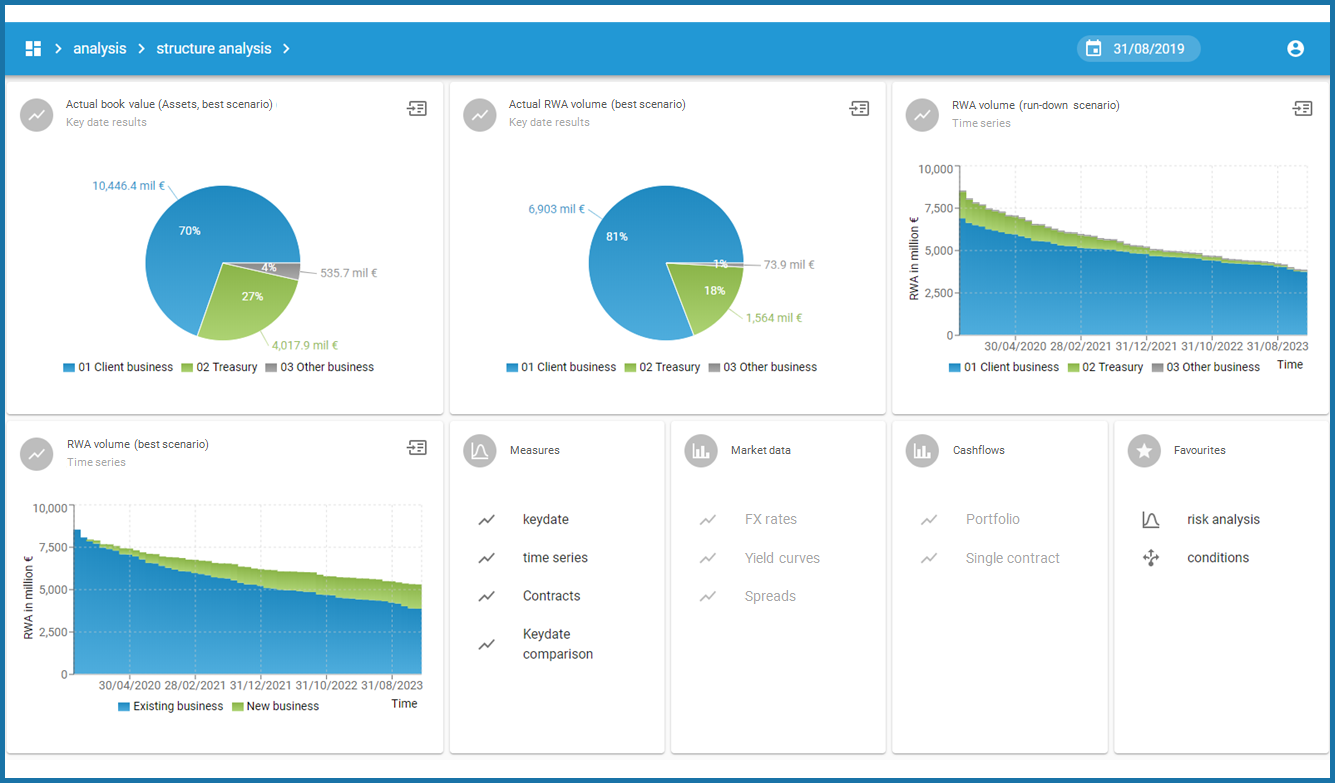

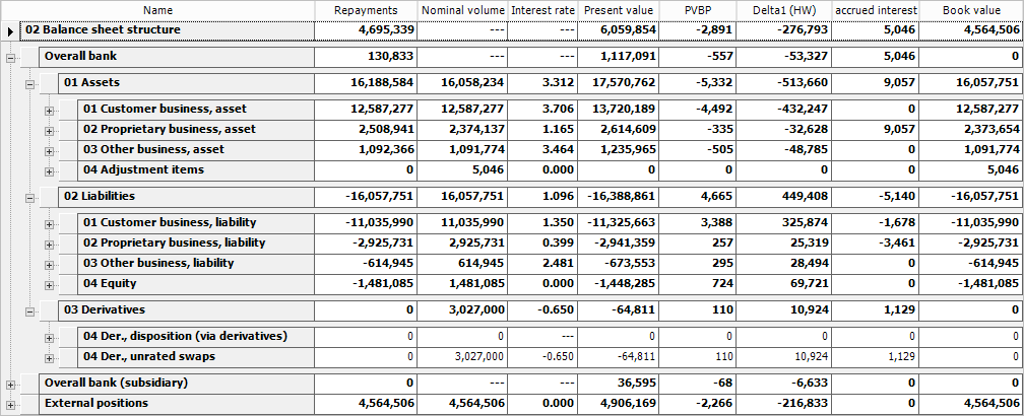

The Treasury module offers extensive profit planning and management as a key instrument for integrated performance and risk management. The following functionalities are available:

- Generation of the bank-wide cash flow

- Results simulation of the annual financial statements and forecast of the development of equity, taking into account different planning parameters/scenarios

- Forecast of net interest income and measurement results

- Interest income balance sheet by net interest spread and transformation result

Experience the versatile possibilities of zeb.control live!

The following product video shows the extensive functions of the software and demonstrates how you can access the multi-layered overviews and analyses.

- zeb’s treasury knowledge included

- Transparency on the interest rate portfolio structure

- Optimization of interest income while maintaining the framework conditions

- Consideration of regulatory requirements

Excerpt of our customers

Your contact persons

Apps that might also interest you

Articles you might be interested in