zeb.control »

Liquidity risk

Quick and easy calculation of liquidity reports in view of increasing regulatory requirements.

Challenges

Fast and simple calculation of regulatory liquidity reports

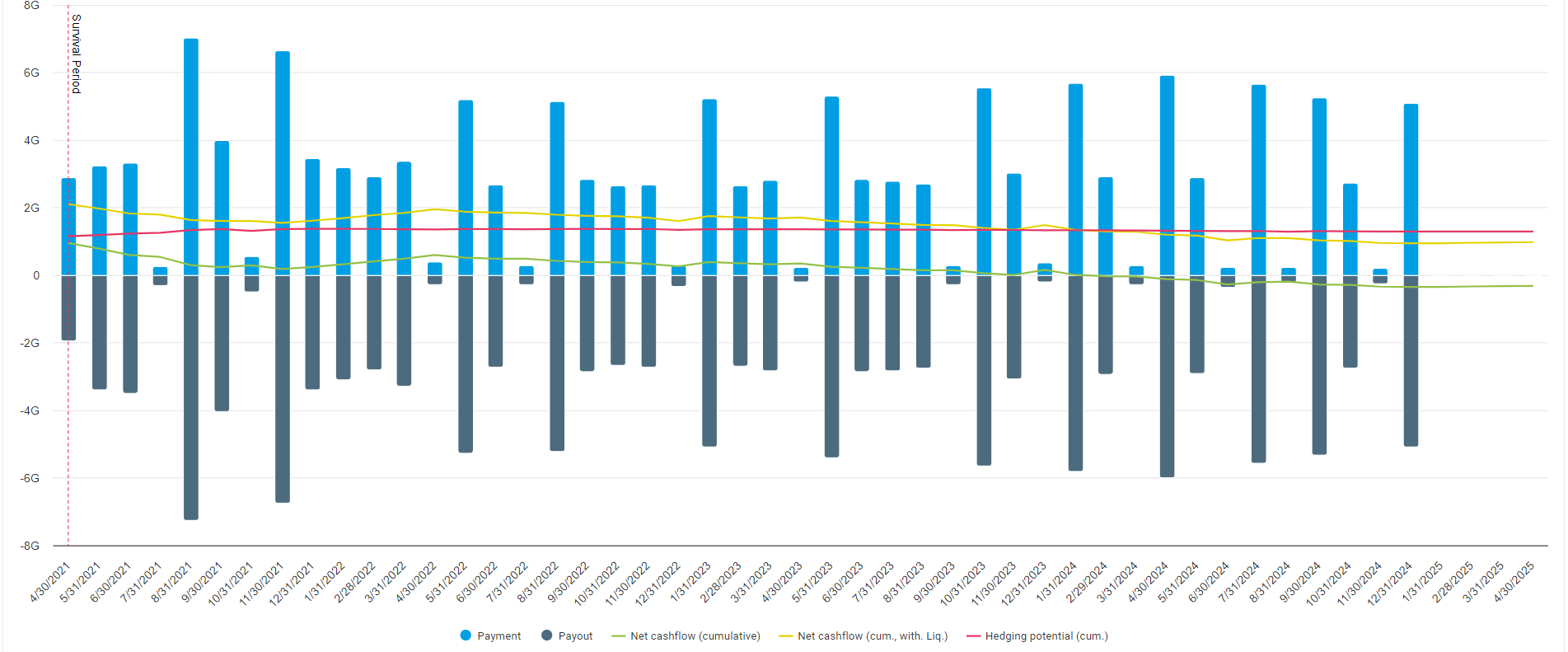

Continuously increasing regulatory requirements and a high market volatility together with high income expectations require banks to apply an active and professional risk management. This includes an active management of the liquidity risk relevant to banks . Another key aspect is the creation and continuous updating of funding plans. These plans help to identify potential liquidity shortfalls at an early stage and to proactively align the bank's refinancing strategy.

Solutions

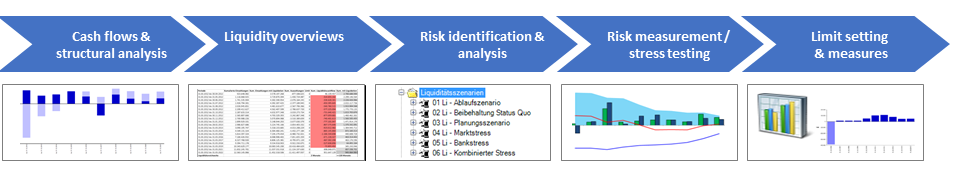

The Liquidity Manager module fully covers the required risk management process

- Generation of liquidity cash flows for individual transactions

- Aggregation according to freely selectable criteria on the basis of a portfolio model to provide liquidity overviews

- Implementation of stress testing using the parameterized risk characteristics

- Derivation of a survival horizon of the bank in a crisis situation (insolvency risk)

- Calculation of the minimum liquidity buffer and indirect costs

- Calculation of the present value-based funding loss (structural liquidity risk)

- Integration of funding plans for proactive refinancing management and compliance with regulatory requirements.

Benefits

- zeb’s expert knowledge of risk management topics as well as of legal and regulatory requirements

- Security through proven solutions and compliance with regulatory requirements

- Transparency about the risk situation with regard to liquidity

- Sustainability through continuous development with regard to professionalism and usability

References

Excerpt of our customers

Contact

Your contact persons

Related Apps

Apps that might also interest you