Challenges

Loss database for parameter determination and historicization

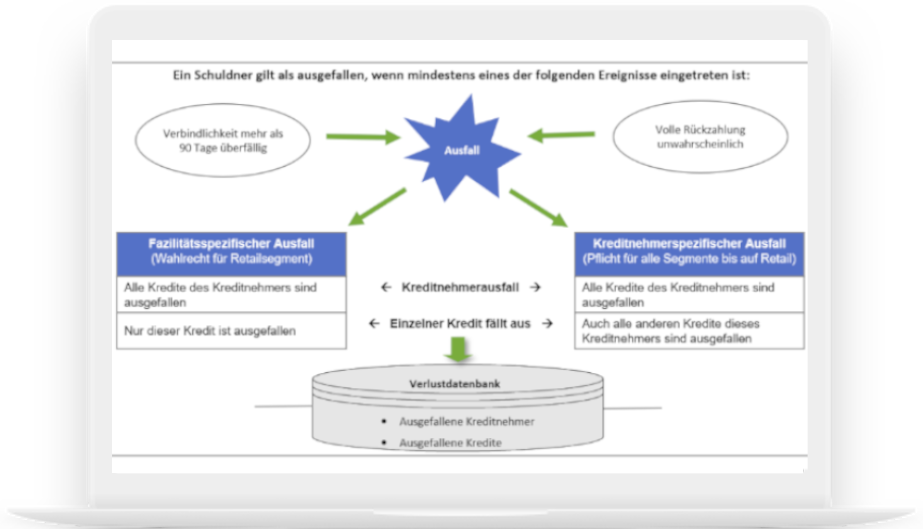

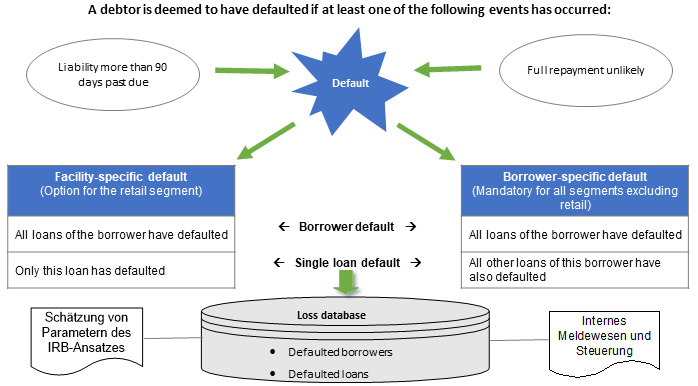

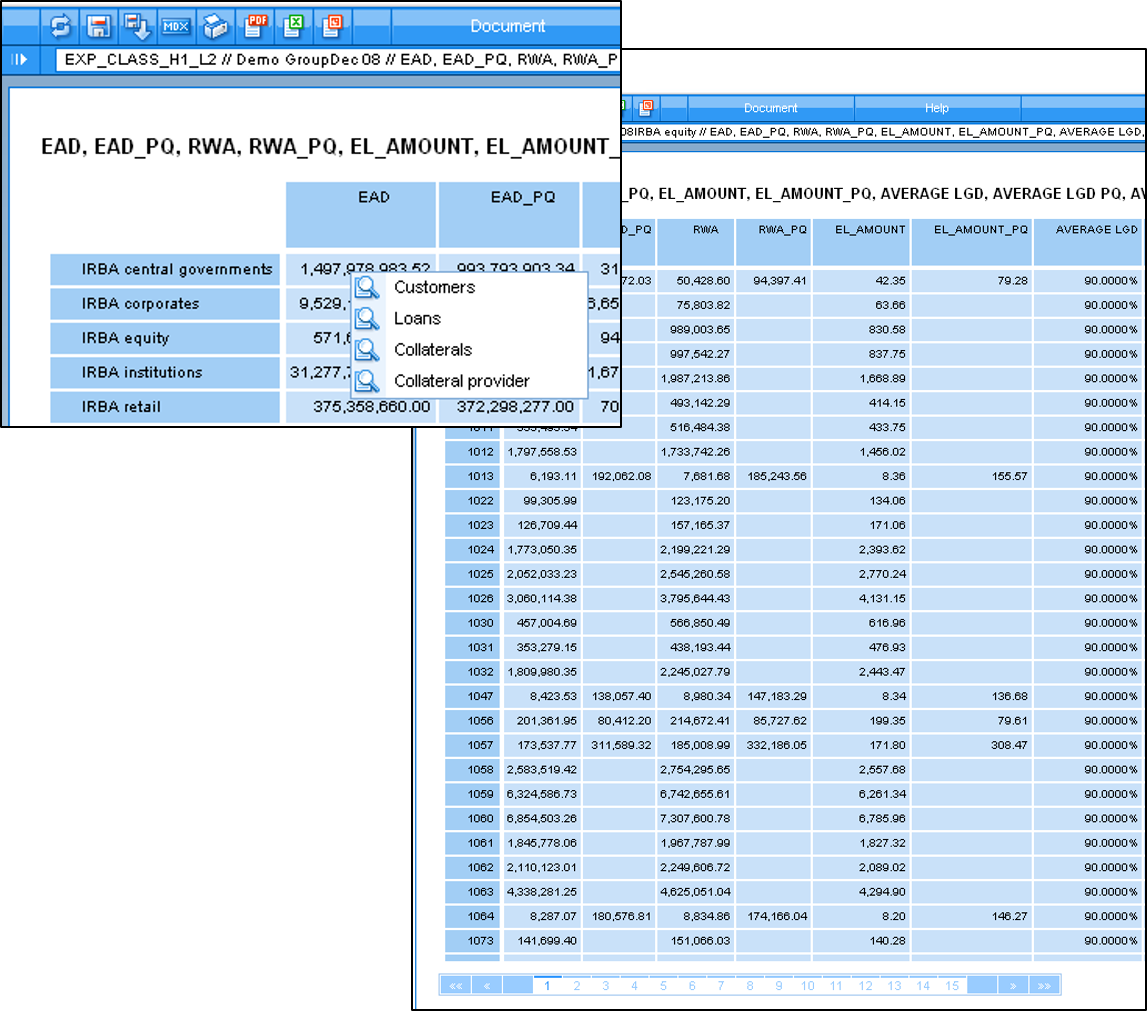

Many banks are faced with the complex and time-critical task of implementing the Basel regulatory reporting requirements. Most IT structures reach their performance limits when implementing the required guidelines. A regulatory-compliant loss database is a mandatory requirement, particularly in order to obtain approval for applying the IRB approaches, for which a complete data history of default data must be maintained.

Solutions

Loss database for parameter determination and historicization

The following range of services of the loss database makes it easy to master the challenges of parameter determination and historicization:

- Provision of regulatory-compliant default and loss detection

- Configuration of default on a customer and/or transaction basis for IRB retail, based on client-specific criteria

- Individual management of loss data historicization by means of event-related data historicization of defaulted transactions and counterparties as well as event systematization based on the default cycle

- Determination of the realized PD, LGD and CCF risk parameters based on loss database history to validate the bank’s internal estimation procedures

Benefits

- zeb’s expert knowledge of legal and regulatory requirements

- Implementation expertise gained at international institutions of different sizes and complexities

- Implementation of an efficient default management with a client-specific design of the calculation methodology

Contact

Your contact persons

Related Apps

Apps that might also interest you

Articles

Articles you might be interested in