Need for optimisation in the implementation of ORSA

Since the introduction of Solvency II, insurance companies have gained extensive experience with the implementation of ORSA (own risk and solvency assessment). The regularly submitted ORSA reports are regularly analysed by BaFin. In the course of these analyses, the supervisory authority identifies needs for action and publishes the results. Both BaFin's comments and zeb's current customer feedback reflect in many places the need for flexible, audit-proof and also software-based processes.

Implementation of ORSA using flexible, audit-proof and software-based processes

The zeb.control Solvency II solution supports your business and risk management. We offer the following services:

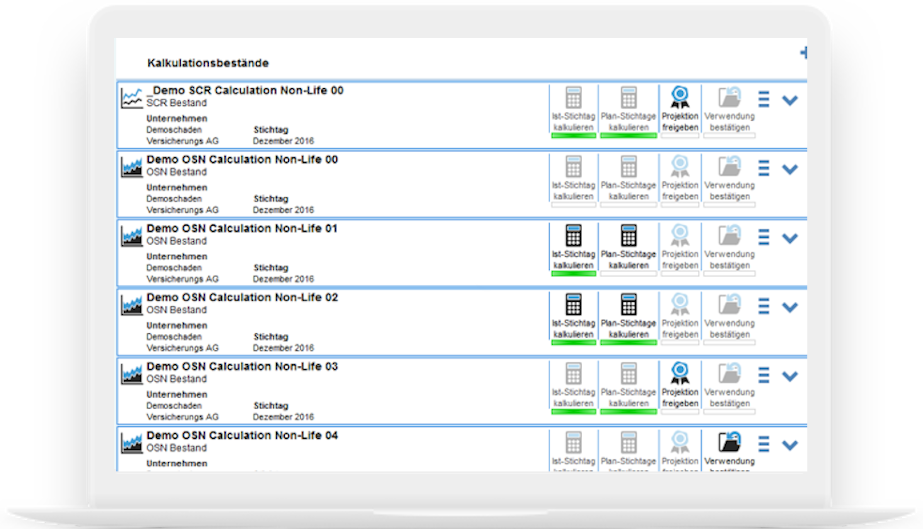

- Complete and consistent mapping and support of a multi-year ORSA planning process to project future coverage

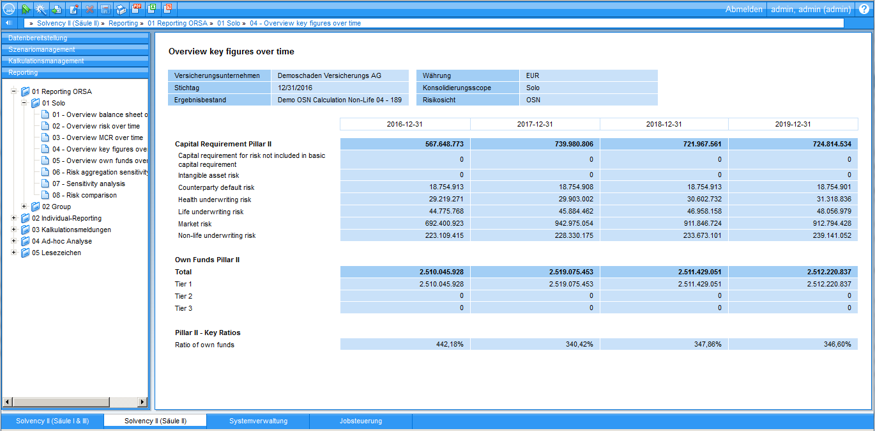

- Complete analysis according to ORSA using various simulation types with subdivision into external events and internal decisions as well as market value simulation, risk simulation, strategic business decisions and tactical management rules

- Definition of various scenarios taking into account the company's own risk profile and carrying out the evaluation of the key performance indicators

- Clear and well-structured set of reports on simulation results for risk and solvency analysis

Experience the versatile possibilities of zeb.control live!

The following product video gives you an overview of the software's extensive functions across all three pillars and shows you examples of how to access the multi-layered overviews and calculations.

- Compliance through audit-proof ORSA process

- Efficiency through fully automated calculations

- Control support through fast calculation of results of scenarios

- Leading provider of solvency solutions in Europe with extensive experience in implementing regulatory reporting solutions

Excerpt of our customers

Your contact persons

Apps that might also interest you

Articles you might be interested in