Financial Conglomerate Reporting

The Implementing Regulation (EU) 2022/2454, which defines the technical implementing standards for Directive 2002/87/EC of the European Parliament and the Council of December 16, 2002, on the supplementary supervision of credit institutions, insurance undertakings, and investment firms within a financial conglomerate, pursues four key objectives:

1. Harmonization and standardization of reporting: The regulation aims to unify the reporting of financial institutions regarding risk concentrations and intra-group transactions. This ensures that relevant data is submitted to supervisory authorities in a standardized format and structure.

2. Enhanced supervision: By requiring detailed and standardized reporting on risk concentrations and intra-group transactions, supervisory authorities are better equipped to monitor and assess the risk exposure of financial groups. This is crucial for financial system stability, as inadequate supervision of such risks can pose systemic threats.

3. Increased transparency: The regulation improves transparency within financial groups by ensuring that information on significant risk positions and intra-group transactions is disclosed regularly and in a standardized manner.

4. Reduction of administrative burden: The introduction of uniform standards and reporting formats alleviates the administrative burden for financial institutions. Instead of complying with varying national requirements, institutions can focus on a single, standardized reporting system.

The regulation mandates that, starting December 31, 2023, financial institutions must submit reports in a standardized XBRL (eXtensible Business Reporting Language) format. This structured, machine-readable format is essential for achieving the regulation’s objectives, as it significantly simplifies the processing, analysis, and exchange of financial data by supervisory authorities. The quarterly generation of these XBRL reports requires software support.

From Taxonomy Compliance to technical release

zeb offers a fully managed Software-as-a-Service solution for XBRL financial conglomerate reporting under the name "FICOD". This solution is entirely operated and maintained by zeb, eliminating the need for financial institutions to manage their own IT infrastructure or install annual taxonomy updates. Compliance with the taxonomy requirements set by Implementing Regulation (EU) 2022/2454 is thus ensured on a recurring basis. The solution supports an efficient and audit-proof reporting process, from data preparation to submission to the supervisory authority.

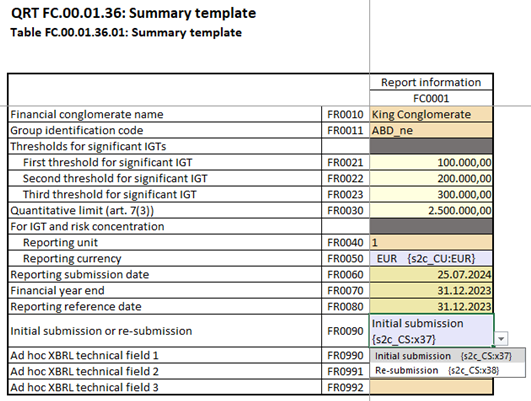

Data is provided via a user-friendly interface in the form of reporting templates, which are also used to display data within the software. The XBRL format for reporting is automatically generated, and an XBRL validation process is carried out with clear error reporting and additional correction options based on the EIOPA taxonomy. As part of an approval process, both individual reports and the entire submission undergo a four-eyes principle review before the final reporting file is downloaded in XBRL format and submitted to the supervisory authority.

- Generation of financial conglomerate reports in XBRL format

- Simple data entry

- Display in reporting template format

- XBRL validation

- Error reporting

- Correction options

- Approval process with four-eyes principle

- Provision of annual taxonomy updates

Excerpt of our customers

Your contact persons

Apps that might also interest you