zeb.Taxonomy-Tool

New terrain EU taxonomy

Starting January 1st, 2023, banks are required to apply the EU Taxonomy for new business and report the Green Asset Ratio (GAR) for the first time in their disclosure reports at the end of the year. The EU Taxonomy covers a total of six environmental objectives, of which only two have been finally published to date. The remaining four environmental objectives are expected to be published in the second half of the year.

To apply the EU Taxonomy, banks must go through more than 2,000 pages of documentation to derive currently more than 260 verification processes based on the first two environmental objectives. The verification is done as part of the credit process, with many banks planning to pass on price advantages to customers who meet the taxonomy requirements.

Credit officers are expected to have additional workload during the process. Involving customers in the information collection process can reduce the burden to some extent. However, it has been observed that corporate customers often expect more intensive support from banks and are less cooperative. On the other hand, retail customers are more cooperative, resulting in higher efficiency advantages due to the higher volume of transactions.

Overview zeb.Taxonomy-Tools

All environmental objectives and Minimum Social Safeguards

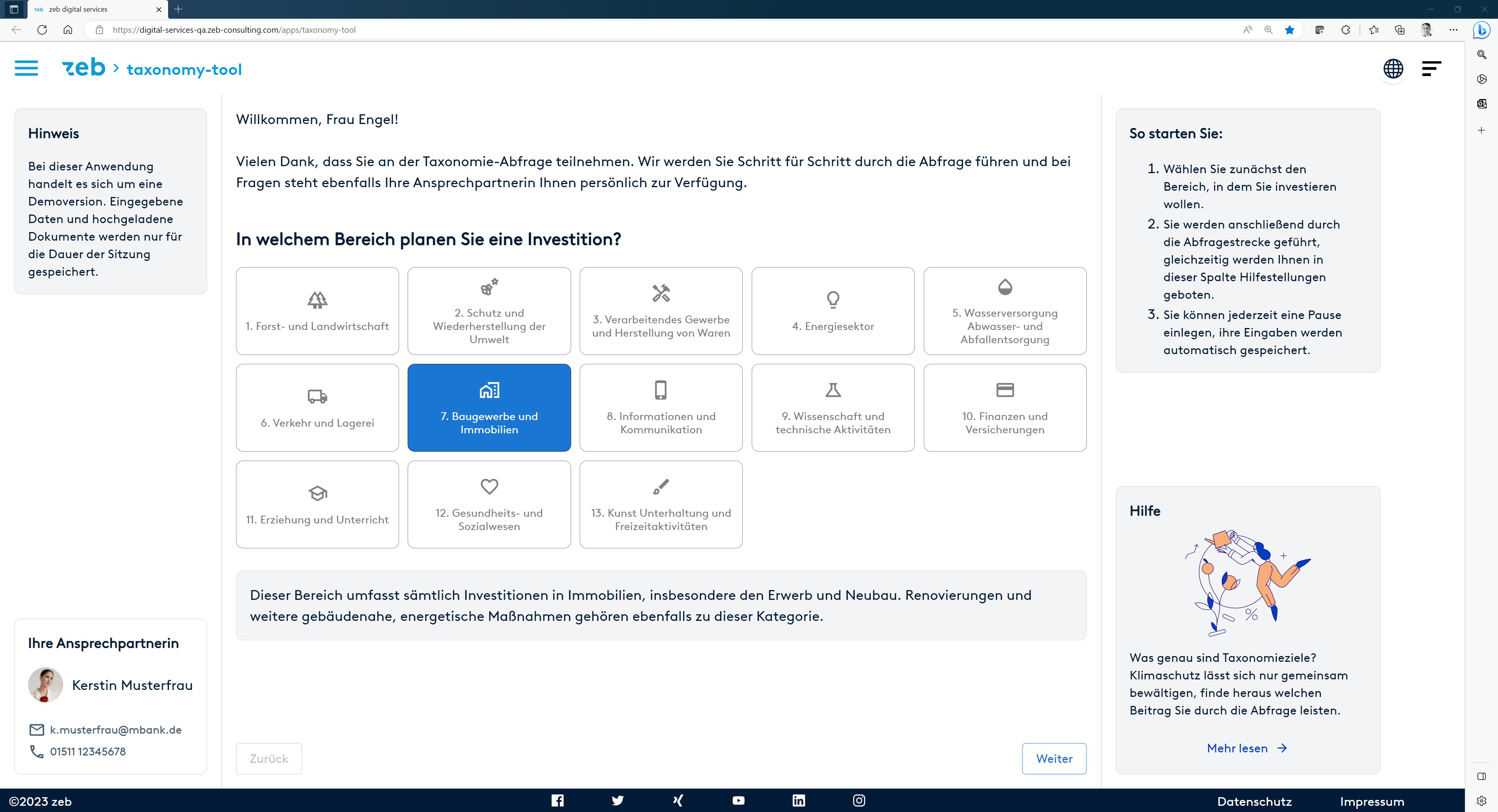

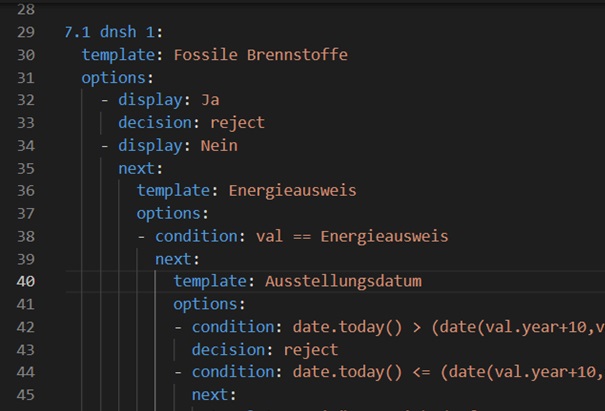

Our software is versatile and suitable for all types of financing, both in the corporate and retail business sectors. The software already includes the two published environmental objectives for the 13 sectors as well as the "Minimum Social Safeguards" (MSS). The remaining 4 environmental objectives will be integrated into the solution directly after their publication. The implementation of rules and questions is elegantly done via YAML, a markup language similar to XML, which allows for structured and uncomplicated transfer of rules and easy publication of new versions.

Easy and intuitive operation

We have recognized from our experience that a direct adoption of the legal texts is too complicated for both the credit officer and the client. Therefore, in implementing our software, we have focused on:

- presenting decision trees in a clear and structured way based on the environmental objectives,

- providing help and explanation texts along the decision trees,

- reusing information, for example when switching between two environmental objectives or when information has already been provided for MSS,

- using an easily understandable language,

- simplifying individual question areas through clever summarization,

- conducting country-specific research to exclude certain question areas, and

- designing the entire web application to be user-friendly and accessible.

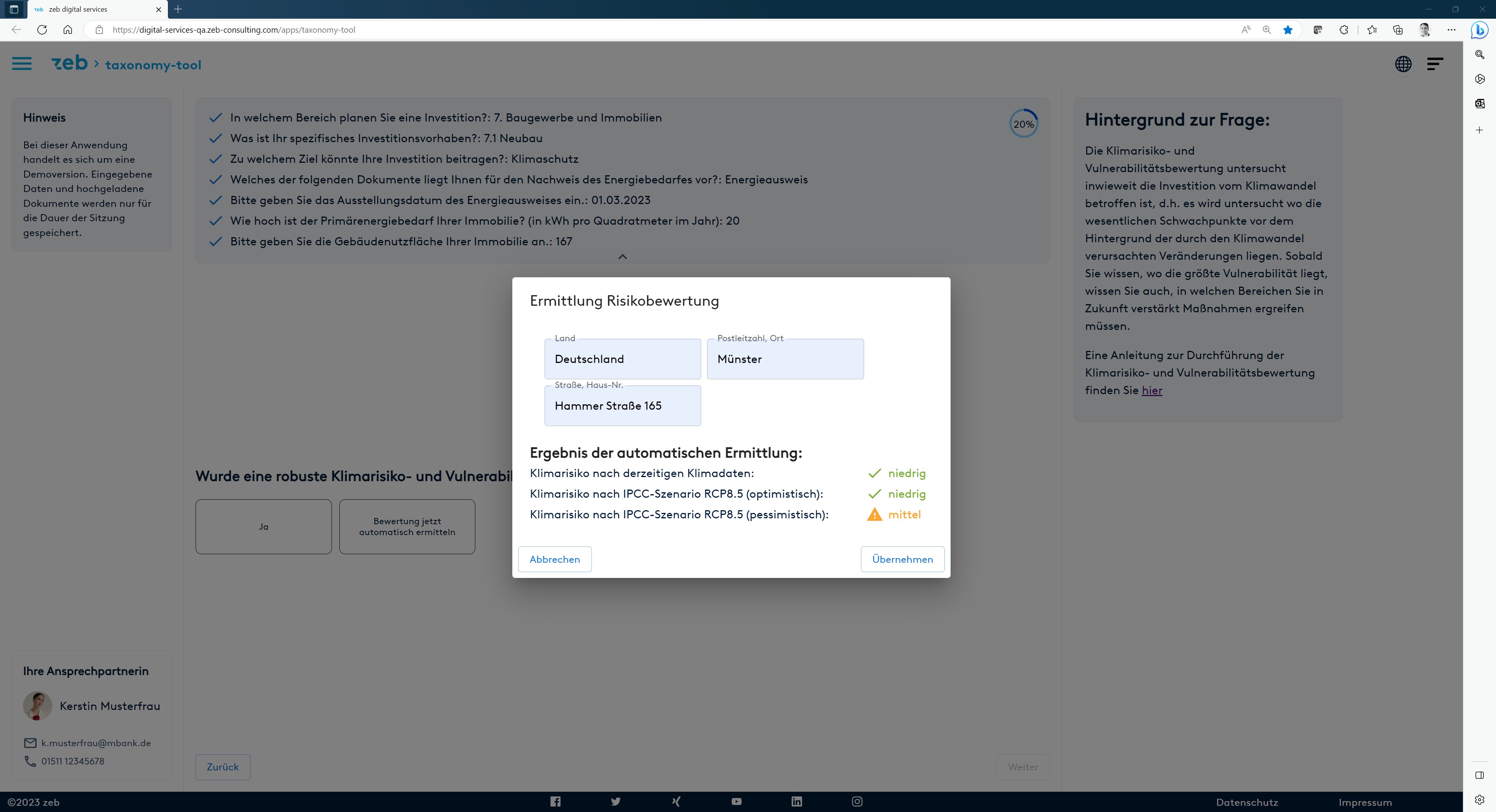

Efficient processing thanks to the use of external sources and OCR integration.

From the user's perspective, many of the requested information can be difficult to provide. The regulations mention public data sources in various places that can be used to automatically derive some information. We systematically analyze these sources and integrate them into our software for physical risks, land/soil use and quality/coverage, water, CO2 emissions from cars, and more. This allows essential information to be automatically derived. In addition, existing information in the credit process, which was determined, for example, by a third-party product, can be directly transmitted to our software via a REST API.

To further improve user-friendliness, our software also includes OCR software that can automatically extract information from standardized sources such as the energy certificate. These measures make our software resource-efficient and easy to use in the bank.

Information can be collected for CO2 accounting, ESG scoring as well as own KPIs

Our belief is that Taxonomy, ESG scoring and CO2 accounting will become increasingly important in the advisory process of banks in the future. In addition, some financial institutions are planning to develop their own KPIs because regulatory requirements do not adequately consider their business models.

As there are significant overlaps in the information requirements between different topics (such as CO2 accounting and Taxonomy), it makes sense to collect this data with a single software. Otherwise, there may be double effort if data needs to be collected through two different software components.

Therefore, we have developed our software in a way that additional information requirements can be captured directly in the frontend by the respective credit officer. Via API, this information can then be queried and used in the bank's systems, ensuring a seamless and efficient data flow that supports collaboration between different areas of the bank.

Modern cloud solution – integrable via REST API as well as usable independently.

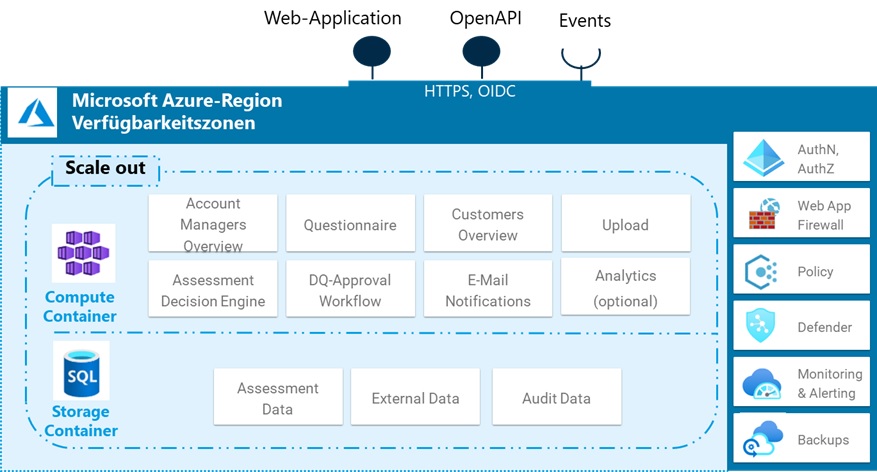

Cloud-Native auf Microsoft™ Azure™

Our IT architecture has been fully implemented on the Microsoft™ Azure™ cloud platform, offering flexibility through the OpenAPI approach. We use proven, secure native cloud services of the highest quality (see figure). Microsoft™ Azure™ Cloud enables us to scale according to compute and storage clusters and real-time load metrics as needed. We ensure high availability through crossavailability zones distributed services backed by a less than 2ms latency interconnection.

High integrability through REST API into the bank's systems

Banks need a flexible EU Taxonomy software that can be integrated into various areas of the IT architecture, such as in the credit process for SMEs and/or retail or in online real estate financing for clients. To meet these requirements, we have developed the software based on an OpenAPI approach, which offers numerous advantages:

- Users can jump directly to operations and transactions from workflow systems or other tools such as CRM.

- Through the API, a tenant single sign-on based on OIDC is possible, which takes into account group membership to predefined groups for role-based access control (RBAC) and is determined by the token claim.

- The operations and basic data can be passed through the API. At the same time, all requested information can also be transmitted via the API, so that the questionnaire can be pre-populated with upstream data. The questionnaire is versioned, and the questions are identifiable. The provided data must meet the formal data requirements.

- The API allows for querying status information, results, and data of cases at any time, so that they can be used by the bank's systems.

- The API returns events to the bank about changes in case status, triggering data queries, for example.

Thanks to these functions, our EU Taxonomy software can be seamlessly integrated into the bank's existing IT architecture, ensuring efficient and transparent compliance with regulatory requirements.

Can also be used standalone without direct integration

Our software can also be used as a standalone solution without direct integration into your system. As software as a service, it is directly available without installation. Additionally, we offer separate administrator access so that you can manage users independently. This way, you can quickly and easily assign appropriate licenses to new employees based on their roles and permissions.

Specialization in financial services and extensive experience in developing regulatory products

Provision of Experts for the Implementation of the EU Taxonomy Tool

Our team is extremely competent and has the necessary expertise, which has been built up over the past months and years in numerous customer projects, to cover all relevant aspects of the EU Taxonomy. We have a comprehensive understanding of all relevant regulations as well as knowledge of the impact on the credit process. In addition, we are able to implement a cloud-based Software-as-a-Service application that is controlled via an API.

Longstanding Experience with the Development of Software as a Service Offerings

Since 2019, zeb's Digital Services Hub has been under development and has been fully implemented in the Microsoft™ Azure™ cloud. It serves as a platform for the rapid and cost-effective development of customized use case apps. To date, more than 70 such applications have been successfully implemented and published on the platform. Our software for implementing the EU Taxonomy also uses the Digital Services Hub as a platform, benefiting from the extensive investments made since 2019.

Focus on Financial Services and Extensive Experience with the Development of Regulatory Software

With decades of experience in the financial industry, we are independent specialists for all aspects of banking and regulatory management - from business model, strategy, finance, risk to software implementation. zeb is in regular contact with European and national supervisory authorities, banking associations, and political decision-makers.

With our focus on the financial services sector and years of experience in the development of regulatory software and ongoing handling of changes in these regulatory issues and the long-term, continuous, and professional further development, we are well acquainted. Three examples, which are also available as Software as a Service:

- Since 2007, zeb has been operating a software for calculating capital requirements (then Basel II, now CRR II), which is used productively by various banks,

- since 2014, zeb has been offering insurance companies software for the calculation and reporting of Solvency II, and

- since 2017, we have been operating the Regulatory Hub (www.regulatory-hub.com), which deals with all European regulatory initiatives.

We are also a reliable and long-term partner for the important topic of the EU Taxonomy!

Your contact persons

This app might also interest you